Transform Your Real Estate Earnings into Lasting Wealth:

Join Our Free 60-Minute Workshop to Eliminate Financial Fragmentation and Maximize Your Income.

The Wealth Edge Blueprint™

How to Build Wealth and Save Taxes as a Real Estate Professional

Align Your Financial Strategies to Stop Wealth Leakage and Build a Cohesive Wealth Acceleration System.

We specialize in transforming fragmented financial tactics into a unified, purpose-driven wealth strategy that not only preserves your earnings but accelerates your wealth growth.

In This Free Workshop, You'll Learn:

The Wealth Edge Blueprint™ Framework

A step-by-step process to optimize your finances and keep more of what you earn.

How to Maximize Deductions

Discover commonly missed deductions and how to claim them properly.

The Best Tax-Efficient Business Structures

LLC, S-Corp, or partnership? Find out which is right for you.

How to Leverage Tax Credits

Use little-known tax credits to legally reduce what you owe.

Demo Live Tax Savings Audit

Walk through real-life scenarios and uncover immediate opportunities to save.

Exclusive Bonuses When You Register Today

BONUS #1: The Ultimate Tax Optimization Guide

Your Year-End Playbook to Saving Thousands on Taxes

This step-by-step guide reveals proven strategies to legally minimize your tax burden before the year ends. Whether you're a real estate professional or entrepreneur, you’ll discover:

Maximization Strategies Ensure you’re claiming every real estate deduction, from repairs and depreciation to mortgage interest.

Tax-Advantaged Accounts Learn how to fund SEP-IRAs, Solo 401(k)s, and HSAs to slash your taxable income.

Strategic Loss Harvesting

Offset capital gains and reduce tax liability without sacrificing long-term growth.

Pass-Through Deductions Unlock the power of the 20% Qualified Business Income Deduction (QBI) for real estate professionals.

Additional Tax-Saving Moves

From charitable giving to estate planning, discover last-minute tax-saving tactics.

Why You Need This Guide:

Why You Need This Guide:

Most real estate professionals overpay in taxes simply because they don’t know what deductions and credits they’re eligible for.

This guide ensures you keep more of what you earn and reinvest it into your financial future.

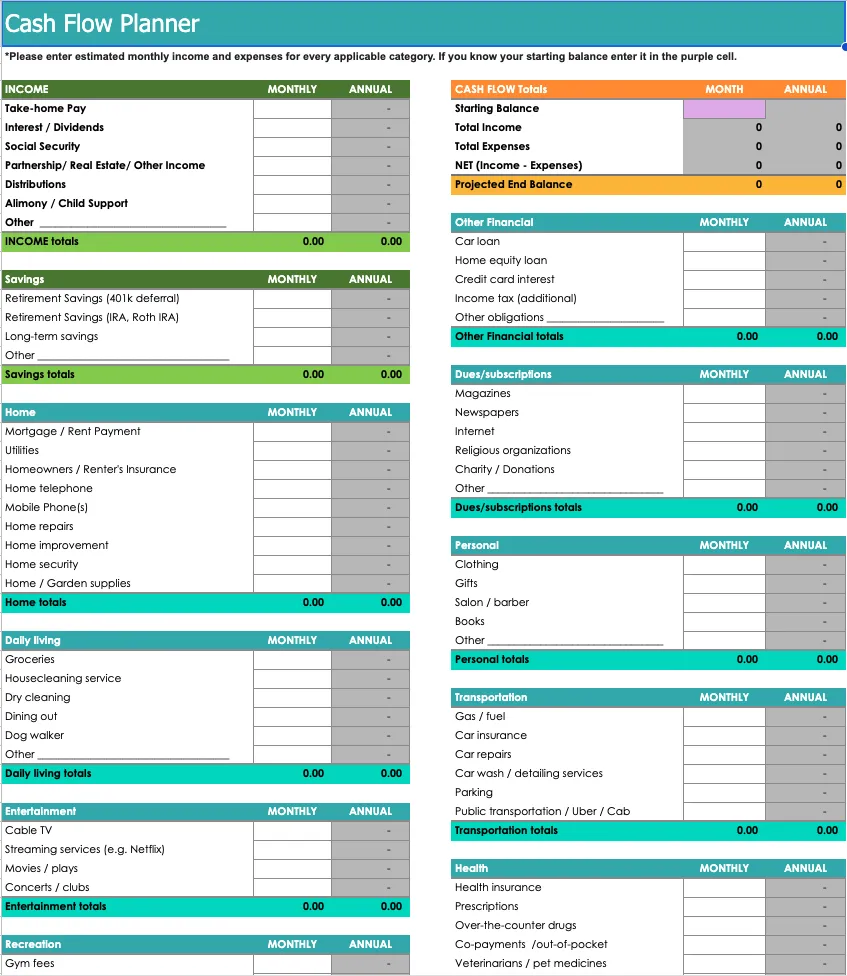

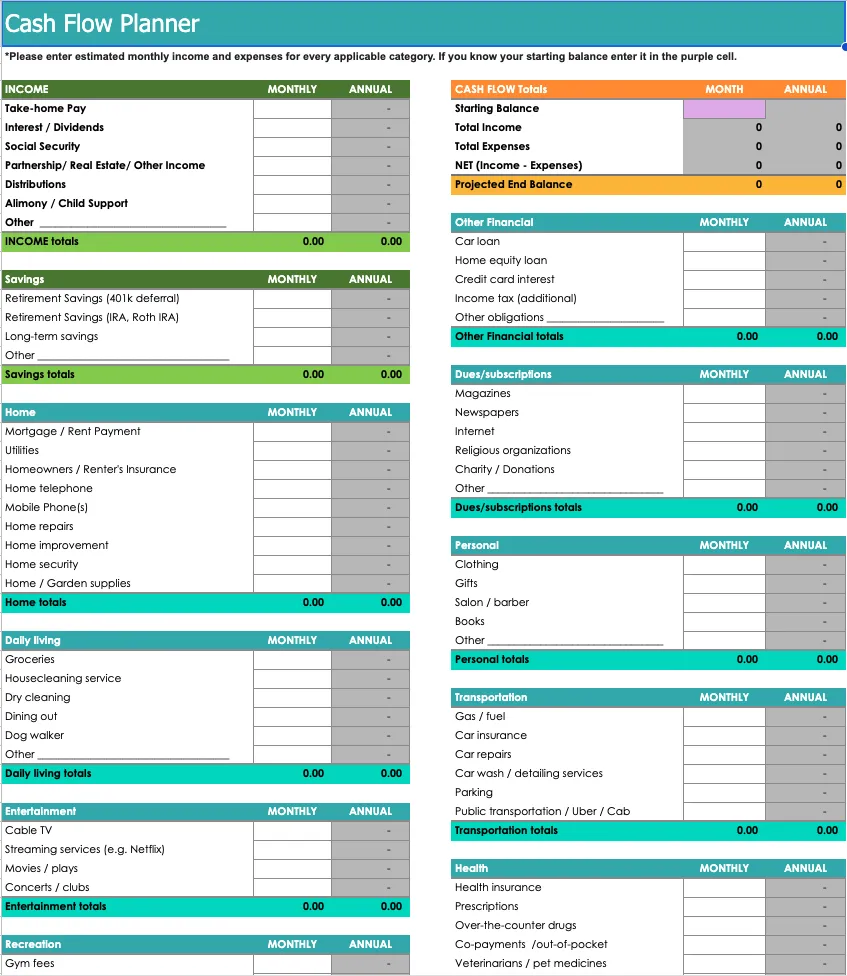

BONUS #2: The Wealth Edge™ Cash Flow Planner

Take Control of Your Finances & Maximize Your Profits

Managing cash flow is critical for real estate professionals and entrepreneurs. Without a clear system, it’s easy to overspend, miss tax-saving opportunities, or struggle with inconsistent income.

That’s why we’re giving you this done-for-you Cash Flow Planner—your personal roadmap to financial clarity and growth.

Track Every Dollar

Gain full visibility into your income, expenses, and investments in one place.

Predict & Plan Smarter

Avoid cash flow surprises by forecasting future revenue and expenses.

Maximize Tax Savings

Easily categorize business expenses and ensure you’re claiming every deduction.

Optimize for Growth

See exactly where your money is going so you can reinvest strategically.

Built for Real Estate Pros Tailored for entrepreneurs with variable income, property expenses, and tax complexities.

Why You Need This Guide:

Why You Need This Guide:

Cash flow mismanagement is one of the biggest reasons businesses struggle.

This powerful tool ensures you stay profitable, organized, and financially stress-free—while making tax time a breeze!

BONUS #3: The Ultimate Tax Hacks Guide

Powerful Tax-Saving Strategies Every Business Owner Must Know

Most business owners overpay on taxes simply because they don’t know the right strategies. This Tax Hacks Guide reveals high-impact tax-saving moves that can help you keep more of your hard-earned money.

S-Corp Tax Savings Reduce Social Security & Medicare taxes while optimizing QBI deductions.

14-Day Tax Free Rental Rent your home for up to 14 days and pay zero taxes on the income.

Maximize Charitable Donations

Donate appreciated stock to avoid capital gains and double your tax benefits.

Hidden Tax Credits Unlock R&D, 45L, and 179D credits to save thousands in taxes.

Bonus Depreciation Hack

Buy a 6,000+ lb vehicle with a small down payment and write it off immediately.

Why You Need This Guide:

Why You Need This Guide:

These little-known tax hacks can save you thousands every year and help you legally minimize your tax burden.

Meet Your Host: Hugh Meyer, MBA

Real Estate’s Financial Planner | Wealth Strategist | Tax Optimization Expert

Hugh Meyer is a Wealth Strategist with over 25 years of experience in financial services, specializing in helping real estate professionals reduce taxes, build wealth, and optimize their financial future.

As the Director of Private Wealth at Highline Wealth Partners, Hugh works with high-income earners to develop strategic financial blueprints that maximize savings and long-term growth.

Extensive Financial Expertise

Managed investment portfolios for high-net-worth clients, specializing in tax-efficient strategies.

Certified Digital Asset Advisor

Expert in navigating modern finanFAQScial tools, including blockchain and alternative investments.

MBA from Loyola Marymount University

Advanced knowledge in wealth management, finance, and tax planning.

20+ Years in Finance

Previous roles at Bear Stearns, Lehman Brothers, and Wells Fargo, advising clients on investment strategies.

“Most high-earning professionals overpay in taxes because they don’t have the right strategy. My goal is to create peace of mind knowing all financial aspects are aligned, freedom to focus on personal passions without financial stress, and fulfillment from building a meaningful legacy.”

Join Hugh for this exclusive webinar and learn how to take control of your financial future!

STILL NOT SURE?

Frequently Asked Questions

WHO IS THIS WORKSHOP FOR?

Real estate professionals, entrepreneurs, and investors who want to optimize their taxes and keep more of their income.

WHAT IF I CAN'T ATTEND LIVE?

Register anyway! A replay will be available for a limited time.

IS IT REALLY FREE?

Yes! This is a value-packed training designed to help you take control of your tax strategy.

HOW DO I CLAIM MY BONUSES?

Attend live, and we’ll send you the bonuses as soon as you logon.

Spots Are Limited

Secure Yours Now!

Don’t miss your chance to learn high-impact tax-saving strategies and claim your free bonuses!

100% No Cost To You!

Limited Spots Available!

Instant Access to Exclusive Bonuses!

Highline Wealth Partners does not provide, and no portion of our Content purports to be, individualized or specific investment or tax advice and Highline Wealth Partners does not provide investment advice to individuals. All information provided by Highline Wealth Partners is general in nature and is made without regard to individual levels of sophistication or investment experience, product availability, investment preferences, investment objectives, risk parameters, or tax consequences and without regard to the suitability of the Content for individuals or entities who may access it.. No information provided by Highline Wealth Partners should be construed as an offer to sell, or a solicitation of an offer to buy any security

or investment vehicle, nor should it be construed as tailored or specific to you, or any reader or consumer thereof. You understand and agree that our content does not constitute specific recommendations of any particular investment, security, portfolio, transaction, or strategy, nor does it recommend any specific course of action that is suitable for any specific person or entity or group of persons or entities. Highline Wealth Partners research Content is based upon information from sources believed to be reliable. Highline Wealth Partners is not responsible for errors, inaccuracies, or omissions of information; nor is it responsible for the accuracy or authenticity of the information upon which it relies

© 2025 Highline Wealth Partners - All Rights Reserved,